Can recurring component templates be attached to employees in bulk?

This feature is available on all PaySpace editions

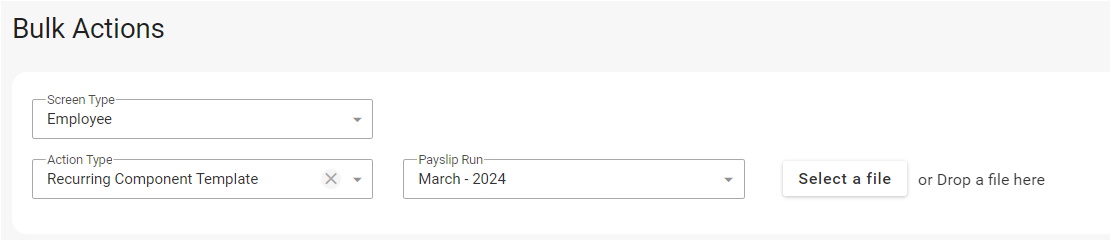

Yes. Recurring component templates can be attached to employees via the Bulk Actions screen.

Navigate > Bulk Actions

Existing templates can also be replaced using this action type. Within the upload template, a column exists to "Replace existing?". The replace option will remove other recurring components from the employee and only add the components part of the uploaded template.

Related Articles

Can recurring payroll components be attached to employees in bulk?

This feature is available on all PaySpace editions Yes. Recurring payroll components can be attached to employees via the Bulk Actions screen. Navigate > Bulk ActionsHow do I add a recurring component?

This feature is available on all PaySpace editions A Recurring component is a regularly appearing component in an employee’s payroll, forming part of their standard compensation package. Recurring components are calculated and included in every pay ...Bulk Actions | Bulk Entries for Multiple Employees

Overview Bulk Entries functionality allows you to capture or import information for more than one employee at a time. Edition This feature is available on all PaySpace editions Navigation Navigate > Bulk Actions Details An extract of the Bulk Actions ...How do I remove a recurring component?

This feature is available on all Deel Local Payroll powered by payspace payroll editions Once Recurring components are linked on employee level, they cannot be deleted on company level. However, they can be made inactive. Payroll Components Step 1: ...Bulk Actions | The Bulk Actions Screen

Overview In addition to processing payroll data for individual employee records, payroll information can also be managed through the Bulk Actions Screen. Bulk entries can be uploaded to either the Payslip Edit Screen or the Recurring Components ...