How do I configure and generate the MIBFA report?

This feature is available on the Premier and Master payroll edition.

To generate the MIBFA report in CSV format, use the Component File Extract report.

The Company MIBFA Config screen needs to be configured prior to extracting the report.

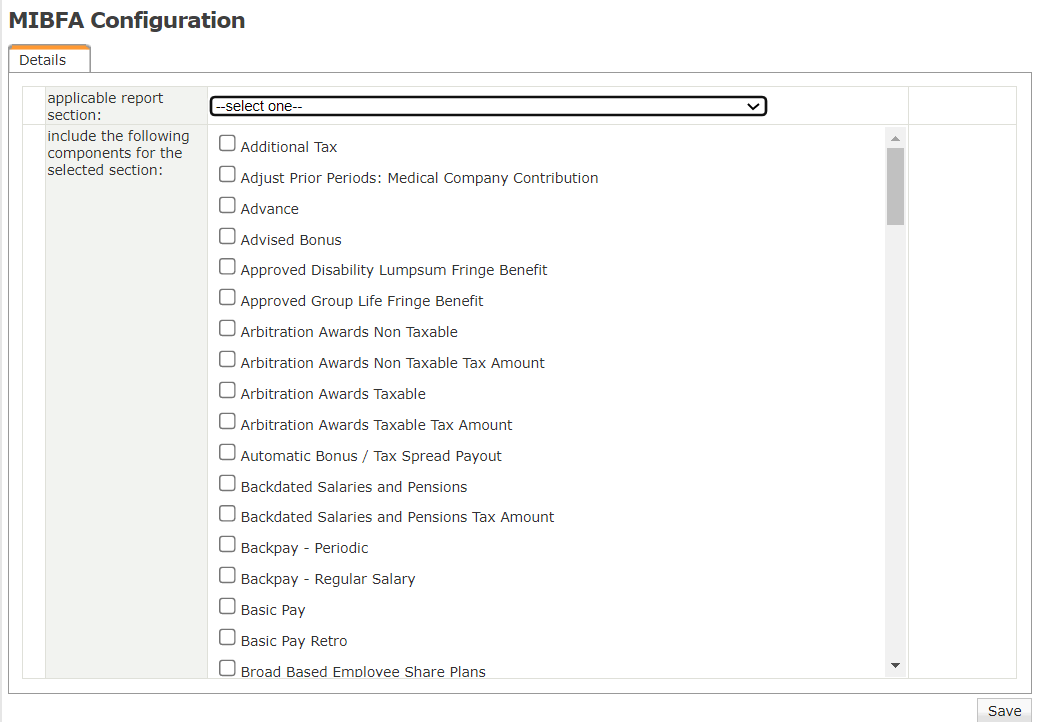

The Company MIBFA Config screen needs to be configured prior to extracting the report.Step 1: Configure the Company MIBFA Config screen.

Navigate > Configuration > Basic Settings > Legislative Configurations > Company MIBFA Config screen

Navigate > Configuration > Basic Settings > Legislative Configurations > Company MIBFA Config screen

Step 2: Generate the MIBFA report using the Component File Extract report.

Navigate > Reports > Reports > Classic > Payroll

Related Articles

How do I extract the General Ledger Report?

This feature is available on all PaySpace editions. The General Ledger Report provides a general ledger listing of the financial entries for a chosen run or period. You have the option to select a file format to export the report from the payroll. ...How do I ensure that the MIBFA company number is reflected in the MIBFA file?

This feature is available on the Premier and Master payroll edition. To ensure that the MIBFA number is reflected in the MIBFA file, insert the number in the "MIBFA company number for the MIBFA file extract" field under the Statutory Settings section ...How do I configure the Bargaining Council components?

This feature is available on all Deel Local Payroll powered by payspace payroll editions Bargaining Council configurations are implemented by our Professional Services department and is a billable exercise. Contact consulting@payspace.com for further ...Reports | Custom File Builder

Overview A powerful new toolset has been released which provides the ability to create plain text-based files that contain Payroll and HR related information. Edition This report is available on Lite / Premier and Master editions. Navigation Navigate ...Why are certain employee's excluded from the EEA Statutory Reports?

Employees may be excluded from the EEA Statutory Reports (i.e. the EEA2 and EEA4 Reports) due processing errors on the payroll. These errors need to be rectified for the employees to be included in these reports. ...