How do I adjust the number of periods worked for employees when they have payslips for periods when they did not work?

The setting explained in this FAQ applies to countries outside South Africa but within the African continent.

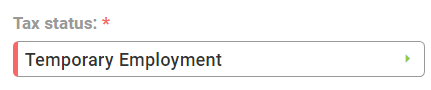

If you want to only count periods in South Africa for actual payslips received, you should link the employee to the Temporary Employment tax status.

For South African entities, should the number of periods worked only be counted for actual payslips received, the affected employee must be linked to the Temporary Employment tax stats on their Tax Profile screen.

Navigate > Employee > Basic Information > Tax Profile > Tax

There are many scenarios where you would want to reduce the number of periods an employee worked, which would apply to the tax factor in the actual tax calculation.

The most common scenario is when an employee was terminated in a previous month and additional payments are made in the following month.

For instance, employee A was terminated on the 20 January and received their leave payment in February. The payroll should not count 2 of 12 periods worked; the payroll should count 1 of 12 periods that employee A worked.

This (and similar) scenario(s) require three steps:

• Select the relevant setting in the Employment Status section on the Company Settings screen.

• Select the “accumulate periods worked as a casual worker:” box on the Employee Tax Profile screen.

• Load the note component, Employee Periods Override.

Step 1: Enable the "Display the temporary status checkbox to accumulate the periods worked as a casual worker" company setting.

Navigate > Configuration > Basic Settings > Company Settings > Company Settings > Employment Status

Step 2: Enable the “accumulate periods worked as a casual worker:” checkbox on the Tax Profile screen.

Navigate > Employee > Basic Information > Tax Profile

Step 3: Create and link the Employee Periods worked override note component on company and employee levels, respectively.

Navigate > Configuration > Payroll > Payroll Config > Payroll Components

Navigate > Employee > Payroll Processing > Edit Payslip > Notes

Note! The component uses actual days of the month in question. In the example above, the current number of periods will be two, but in the component scale this will be considered zero. Therefore, to reduce the number of periods by one, the actual number of days of the month in question should be entered (28 days for February, in this example). Therefore, an amount of -28 should be entered. If the month in question was August, -31 days would have to be entered.

If you want to define the number of days in the month, for example you only want to capture 10 days worked, you will enter 10 in the note component. The system will take the 10 days entered and calculate 10/31 = 0.322580 days for August and get to a daily ration out of 12. Therefore, your periods will be 0.322580 / 12.

Related Articles

How do I configure the system to only accumulate one period worked when calculating "Periods Worked" (tax calculation)?

In some African countries, it is not common practice to calculate employees' tax using the periods worked on a pro rata basis for the periods worked, when an employee is engaged or terminated during a month. For example, if an employee started ...Payroll Processing | Recurring Payroll Components

A Recurring component refers to a regularly appearing component in an employee's payroll that is a part of the employee's regular compensation package. These components are calculated and included in each pay period, and are an essential part of an ...Which component can be used as a tax override component to disregard an employee's system calculated tax amount, and instead apply an advised amount?

This feature is available on all PaySpace editions The "Suppress Tax Paid" note component can be used as a tax override component to disregard an employee's system calculated tax amount. It will allow you to advise an amount on an employee's ...How do I adjust an employee's medical aid to provide for a prior periods' medical aid contribution/deduction?

This feature is available on all PaySpace editions. An employee's Medical Aid can be adjusted to account for prior periods. Navigate > Configuration > Payroll > Payroll Config > Payroll Components Step 1: Search for and add the "Adjust Prior Periods: ...Morocco | How can I store an employee's additional days worked?

To store an employee's additional days worked, the Note component: Additional Days Worked must be created on company level before it can be linked on employee level. When a value is captured, it will be used to determine the "Tax Factor" used to ...