South Africa | Why Is An Employee Not Populating On The UIF Report Even Though There Are UIF Contributions On The Payslip?

This feature is available on all Deel Local Payroll powered by payspace payroll editions

This feature is available on all Deel Local Payroll powered by payspace payroll editions

This feature is available on all Deel Local Payroll powered by payspace payroll editions

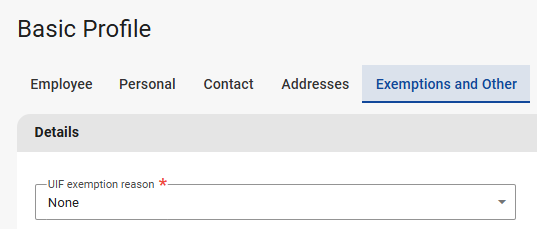

This feature is available on all Deel Local Payroll powered by payspace payroll editionsEnsure that the employee has a UIF Exemption Reason selected on their Basic Profile screen. Even if the employee is not exempt for UIF, the reason "None" should then be selected. This field is a mandatory field to be completed.

Navigate > Employee > Basic Information > Basic Profile > Exemptions and Other

Once a reason is selected and, assuming there are UIF contributions on the employee's payslip for the particular period, the employee should populate on the UIF Report.

Related Articles

South Africa | Employees Missing From The UIF Report

This feature is available on all Deel Local Payroll powered by payspace payroll editions If an employee has UIF Income and UIF contributions on their payslip, ensure that UIF Exemption Reason has been selected. If UIF should calculate then the ...South Africa: Are commision earners excluded from UIF?

As per legislation, UIF is not deducted for commission earners. This applies to employees whose earnings are made up 100% of commission only. The Unemployment Insurance Fund (UIF) exemption reason: "Employee earns commission only" is configured on ...South Africa: Transfers using the statutory override option for UIF

Employee Transfers Employees can be transferred between different frequencies in the same company and between different companies in the same company group. Navigate to the employee > On / Off Boarding > Transfer When an employee is transferred ...South Africa | Foreign Employment Exemption

The Foreign Employment Tax Exemption applies to South African tax residents working outside South Africa for a period exceeding 60 continuous days and for a period exceeding 183 full days in aggregate, during any 12 months. Previously, there was no ...South Africa | Understanding A Valid UIF Employer Reference Number

This feature is available on all Deel Local Payroll powered by payspace editions A UIF employer reference number is the unique ID given to an employer by the Unemployment Insurance Fund. It’s used for all UIF processes, including uFiling and ...