Malawi: 2022/2023 Tax changes

The 2022/2023 Budget Statement was Delivered to the National Assembly of the Republic of Malawi by the Minister of Finance and Economic Affairs on Friday, the 18th of February 2022. The proposed changes came into effect on the 1st of April after the enactment of the Taxation (Amendment) Act, 2022. In the effort of continuing to improve the progressivity of the Pay As You Earn (PAYE) system and ensuring that Government continues to raise realistic revenues from PAYE, the monthly PAYE schedule has been revised.

Changes to the second and third brackets were made.

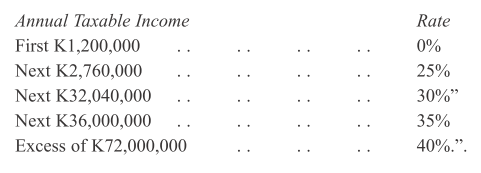

The Taxation (Amendment) Act, 2022 amended the Rates of Income Tax on Employment Income:

Related Articles

Malawi: Proposed tax changes 2022/2023

The Minister of Finance and Economic Affairs Sosten Gwengwe has presented the 2022/2023 national budget for Malawi. Please note that the Income Tax changes will be effective on the 1st of April 2022 once the relevant Bills have been passed by ...Malawi Payroll Tax Guide 2024-2025

The Malawi Payroll Tax Guide is an easy-to-understand summary of statutory contributions associated with payroll for the 2024-2025 tax year.Malawi Payroll Tax Guide 2025-2026

The Malawi Payroll Tax Guide is an easy-to-understand summary of statutory contributions associated with payroll for the 2025-2026 tax year.Malawi | New Tax Measures for Mid-Year Budget Review

The Honourable Minister of Finance, Economic Planning and Decentralization presented the 2025/26 Mid-Year Budget Review to Parliament on Friday, 21st November, 2025. New tax measures for Domestic Taxes and Customs & Excise were announced. The new ...Malawi - Budget Speech proposes changes to PAYE Tables for 2024/2025 - Effective 1st April 2024

In Malawi, The Minister of Finance and Economic Affairs recently announced proposed PAYE changes for the 2024/2025 tax year. The proposed changes include an increase to the zero Pay As You Earn (PAYE) bracket from K100,000 to MK150,000. Accordingly, ...