Kenya | How do I configure the system so that an employee's bonus is included in their regular earnings tax calculation?

To make sure an employee's bonus is included in their regular earnings tax calculation, use the Bonus (Regular Earning taxation) component.

Step 1: Create the component on company level.

Navigate > Configuration > Payroll > Payroll Config > Payroll Components

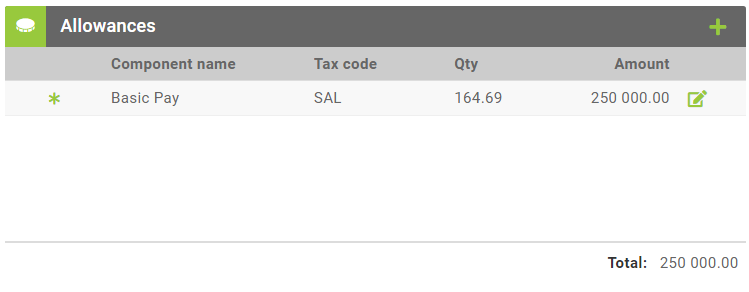

Step 2: Add the component to an employee on their Edit Payslip screen or collectively on the Bulk Actions screen.

Navigate > Employee > Payroll Processing > Edit Payslip > Allowances

Related Articles

Payroll Processing | Recurring Payroll Components

A Recurring component refers to a regularly appearing component in an employee's payroll that is a part of the employee's regular compensation package. These components are calculated and included in each pay period, and are an essential part of an ...Mali | How do I include or exclude components in AMO Earnings?

AMO Earnings by default will include tax codes: SAL BONUS OTHER OTHEREXCL EXPATA 10TAX To include or exclude tax codes, we have added a Component Taxability Screen where these changes can be made. Config > Payroll > Payroll Config > Component ...How do I setup the Automatic Bonus / Tax Spread component?

This feature is available on all Deel Local Payroll powered by payspace editions An employee may choose to spread the tax on a guaranteed bonus over the tax year using the Automatic Bonus/Tax Spread component . This should ideally be processed in ...Components | The Payroll Components Screen

Overview The Company Payroll Components screen stores a library of payslip actions a company requires on employee level. This includes automatic components (that will automatically populate/calculate on the Edit Payslip screen every period), and ...Kenya Payroll Tax Guide 2024

The Kenya Payroll Tax Guide is an easy-to-understand summary of statutory contributions associated with payroll for the 2024 tax year.