How to add or edit an employee's tax directive's (lump sum) issue date?

This feature is available on all PaySpace editions.

Make use of these steps to add or edit the tax directive issue date:

Navigate > Employee > Payroll Processing > Edit Payslip > Other Actions > Lump Sum Directive

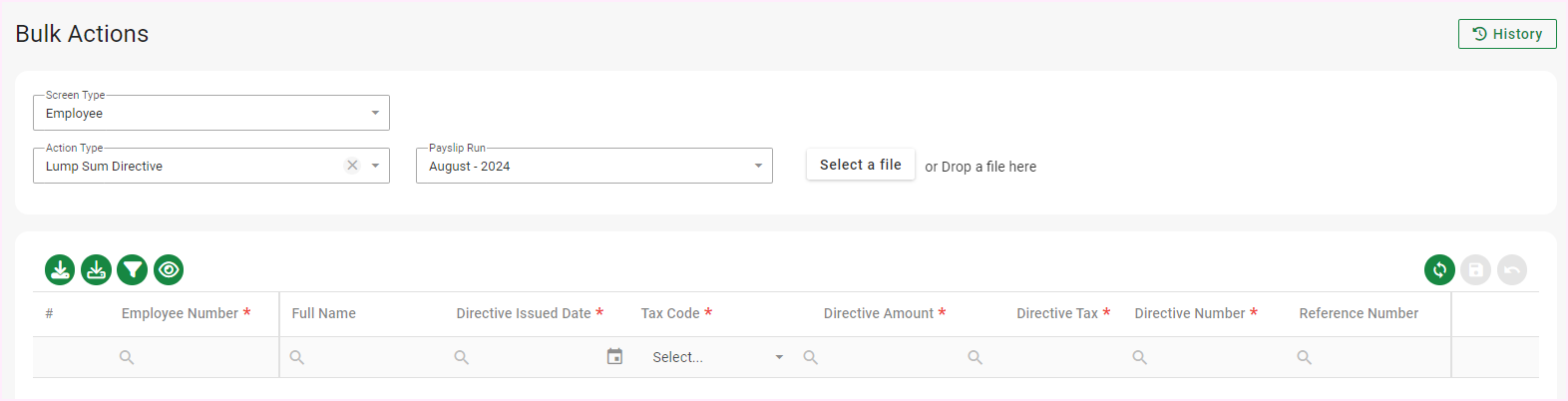

Navigate > Bulk Actions

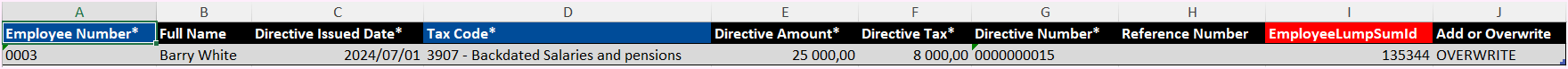

Step 1: Download an empty spreadsheet for the lump sum directive bulk upload.

Step 2: Select "Overwrite" in the Add/Overwrite column to update an existing entry. N.B. this will only update the "Issued date" field

Step 3: Advise the relevant employee number and directive number that you want to update (these must match to an existing lump sum directive)

Step 4: Specify the correct Directive Issued Date (this must be for the current tax year, per SARS).

Step 5: Upload the spreadsheet.

Related Articles

Where do I add an employee's Lump Sum (tax) Directive?

This feature is available on all Deel Local Payroll powered by payspace payroll editions The purpose of a tax directive is to enable SARS to instruct an employer on how to deduct employees' tax from certain lump sums to a taxpayer or member. An ...Can lump sum directives be processed on an employee's Take on Year To Date Figures screen?

This feature is available on all PaySpace editions No. Lump sum directives cannot be processed on an employee's Take on Year To Date Figures screen. A Lump sum directive needs to be processed on the Edit Payslip screen. Navigate > Employee > Payroll ...Where can an employee’s tax directive number be viewed?

The purpose of a tax directive is to enable SARS to instruct an Employer, how to deduct employees' tax from certain lump sums to a taxpayer or member. An employee's directive number can be viewed on the "Other Actions" button in the top right hand ...Can employee lump sum directives be created via the Bulk Actions screen?

This feature is available on all PaySpace editions Yes. Employee lump sum directives can be created via the Bulk Actions screen. Navigate > Bulk ActionsWhich report can I extract to view employee lump sum and tax directive payments?

This report is available on all PaySpace editions. To view employee lump sum and tax directive payments, generate the "Lump Sum Report". Navigate > Reports > Reports > Classic > Payroll