How Does PaySpace Calculate The Periods Worked On The Employee Tax Drilldown Screen?

A period worked is based on the calendar days in the month. One full period indicates that the employee worked for the entire month.

The periods worked will accumulate year-to-date as the months progress, assuming the employee worked during those months.

Example:

If the tax year starts in March and the employee was already actively employed since then, but the current month is June, the number of periods worked would be four (March to June).

Further considerations:

The number of periods worked are also driven by the employee's employment and termination date.

If an employee has an employment date of the 20th of May, then the period would prorate. Therefore in May, the periods worked would be 0.387096774 (12/31).

Then in June, if the employee worked the full month, the accumulated periods worked would be 1.0387096774.

The same principles would apply if the employee was terminated mid-month.

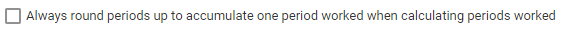

Note: Should a period be rounded up to 1 period and not prorate, then the below Calculation Setting can be ticked:

Related Articles

How do I configure the system to only accumulate one period worked when calculating "Periods Worked" (tax calculation)?

In some African countries, it is not common practice to calculate employees' tax using the periods worked on a pro rata basis for the periods worked, when an employee is engaged or terminated during a month. For example, if an employee started ...How do I adjust the number of periods worked for employees when they have payslips for periods when they did not work?

The setting explained in this FAQ applies to countries outside South Africa but within the African continent. If you want to only count periods in South Africa for actual payslips received, you should link the employee to the Temporary Employment tax ...Senegal: Why would the periods worked round to a full period without the company setting being activated?

An option is available for companies to use a full period in the tax calculation for employee records which are engaged or terminated mid month, and where no pro ration calculation should be applied. A further option is available on employee level ...How to correct e@syFile™ error: Pay Periods worked (3210) contains the following invalid characters ('-')

This feature is available on all Deel Local Payroll powered by payspace editions The error appears in e@syFile™ because the company’s Frequency Tax Year is set up for the current Tax Year, but the employee is still linked to the previous Tax Year, ...Morocco | Number of Days Worked On CNSS Report

The CNSS Monthly report is a Monthly CNSS electronic declaration file, on this report there is a field for number of day worked. The number of day worked default to 26 days if the Tax factor is false, where the tax factor is true the field will ...