How do I correct an employee's Reimbursive Travel Allowance that has been incorrectly captured against tax code 3702 (taxable) instead of tax code 3703 (non taxable)?

This applies to all PaySpace editions.

For example, an employee travelled 120km in May 2024, but it was incorrectly captured on tax code 3702 (Reimbursive Travel Allowance Taxable) instead of 3703 (Reimbursive Travel Allowance Non-Taxable). However, this mistake was only picked up in August 2024.

In order to correct this, the following configurations need to be done:

Step 1: Create a correction run linked to the last closed run.

Related FAQ: How do I create an interim (correction) run?Navigate > Payroll Cycle > Payslip Pay Dates

Step 2: Once created, create a payslip linked to this correction run.

Navigate > Employee > Payroll Processing > Edit Payslip

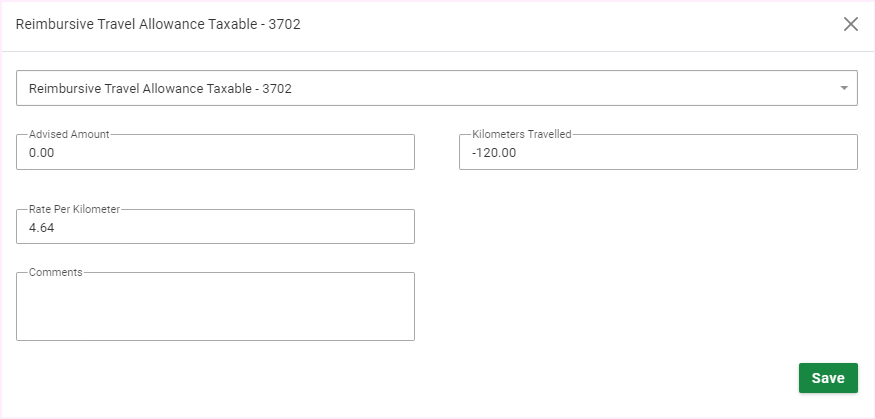

Step 3: Add the Reimbursive Travel Allowance Taxable (tax code 3702) component on the payslip and process a negative amount, to reverse the reimbursement amount incorrectly captured.

Navigate > Employee > Payroll Processing > Edit Payslip > Allowances

Step 4: Add the Reimbursive Travel Allowance Non Taxable (tax code 3703) component with the positive amount, so that the reimbursement is captured correctly.

Navigate > Employee > Payroll Processing > Edit Payslip > Allowances

Step 5: Close the interim run.

Navigate > Payroll Cycle > Payslip Pay Dates

Related Articles

How do I record an employee's Reimbursive Travel Allowance on tax codes 3702 and 3722?

This feature is available on all PaySpace editions. Tax code 3722 (Travel Reimbursement (Fully Taxable) ) is only applicable where the reimbursement rate used by the employer exceeds the prescribed rate and only in respect of that portion of the ...How do I configure the Reimbursive Travel Allowance (taxable and non taxable) claim components to automatically apply the SARS rate per hour?

This applies to all Deel Local Payroll powered by payspace payroll editions A Reimbursive Travel Allowance is an allowance which is based on the actual distance travelled for business purposes (excluding private travel). These amounts are normally ...How do I resolve the payslip error: "Reimbursive Travel allowance requires a rate per km", when adding the Reimbursive Travel Allowance Non Taxable/Taxable component?

This feature is available on all Deel Local Payroll powered by payspace payroll editions When adding the taxable or non-taxable Reimbursive Travel Allowance component to an employee's payslip, the "Reimbursive Travel allowance requires a rate per km" ...How do I configure a Reimbursive Travel Allowance component?

This applies to all Deel Local Payroll powered by payspace payroll editions A Reimbursive Travel Allowance is an allowance which is based on the actual distance travelled for business purposes (excluding private travel). These amounts are normally ...Can I reverse an incorrectly captured tax directive once the run has closed?

Yes. The system has been enhanced to allow an incorrectly captured tax directive to be reversed after the run in which it was captured has been closed. If the directive was captured on a terminated employee's record, create an interim run linked to ...