How do I configure the system to only accumulate one period worked when calculating "Periods Worked" (tax calculation)?

In some African countries, it is not common practice to calculate employees' tax using the periods worked on a pro rata basis for the periods worked, when an employee is engaged or terminated during a month.

For example, if an employee started working on 10 March, they would have only worked 22 days for the month. By system design, the prorated "Periods Worked" calculation will show 22 days worked out of 31 calendar days in March = 0.7096774194 (i.e. a fraction of the month worked). This figure will be used in the tax calculation (0.7096774194/12).

To change the calculation to use 1/12 for all employees, regardless of their engagement or termination date, you should enable the "Always round periods

up to accumulate one period worked when calculating periods worked" checkbox under the General Calculations section on the General Settings screen.

Navigate > Configuration > Payroll > Payroll Config > Calculation Settings > General Calculations

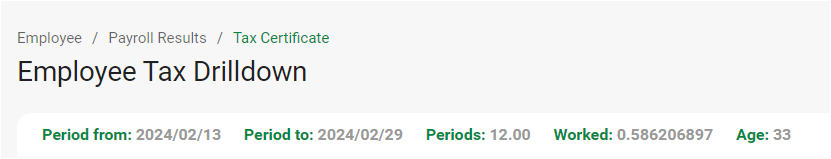

The employees' Tax Certificates / Historical Drill Down screen will show that the Periods Worked value has changed from 0.709677419 to 1.

Navigate > Employee > Payroll Results > Tax Certificates / Historical Drill Down

Navigate > Employee > Payroll Results > Tax Certificates / Historical Drill Down

Before the company setting was enabled -

After the company setting was enabled -

Related Articles

How Does PaySpace Calculate The Periods Worked On The Employee Tax Drilldown Screen?

A period worked is based on the calendar days in the month. One full period indicates that the employee worked for the entire month. The periods worked will accumulate year-to-date as the months progress, assuming the employee worked during those ...How do I adjust the number of periods worked for employees when they have payslips for periods when they did not work?

The setting explained in this FAQ applies to countries outside South Africa but within the African continent. If you want to only count periods in South Africa for actual payslips received, you should link the employee to the Temporary Employment tax ...How to correct e@syFile™ error: Pay Periods worked (3210) contains the following invalid characters ('-')

This feature is available on all Deel Local Payroll powered by payspace editions The error appears in e@syFile™ because the company’s Frequency Tax Year is set up for the current Tax Year, but the employee is still linked to the previous Tax Year, ...Senegal: Why would the periods worked round to a full period without the company setting being activated?

An option is available for companies to use a full period in the tax calculation for employee records which are engaged or terminated mid month, and where no pro ration calculation should be applied. A further option is available on employee level ...How do I correct e@syFile™ Employer error: "Pay Periods worked (3210) contains the following invalid characters ('-')"?

This feature is available on all Deel Local Payroll powered by payspace editions This error appears on e@syFile™ Employer when the frequency tax year is set up within the current tax year, but the employee is linked to the previous tax year. For ...