How do I configure a Reimbursive Travel Allowance component?

This applies to all Deel Local Payroll powered by payspace payroll editions

A Reimbursive Travel Allowance is an allowance which is based on the actual distance travelled for business purposes (excluding private travel). These amounts are normally paid by an employer to an employee by multiplying the actual business kilometres travelled by a rate per kilometre.

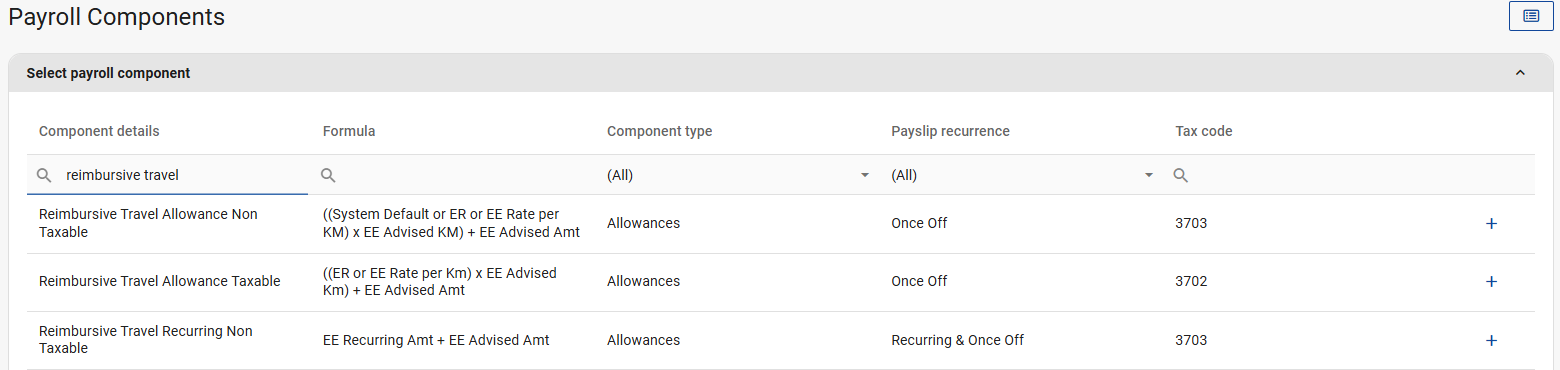

Determine whether the Reimbursive Travel Allowance will be taxed or not, then create the applicable component on company level.

Navigate > Config > Payroll > Payroll Config > Payroll Components

Navigate > Config > Payroll > Payroll Config > Payroll Components

When to use the Reimbursive Travel Allowance Taxable component (3702): This code is only applicable where the reimbursement rate used by the employer exceeds the prescribed rate, and/or the employee receives any other form of compensation for travel; and only in respect of that portion of the reimbursement that does not exceed the amount determined by multiplying the prescribed rate by the actual business kilometres travelled.

When to use the Reimbursive Travel Allowance Non-Taxable component (3703): This code is only applicable where the reimbursement rate used by the employer does not exceed the prescribed rate, and the employee does not receive any other form of compensation for travel; and in respect of the full value of the reimbursement.

Important

ImportantThis code must not be used together with code 3701, 3702 and/or 3722.

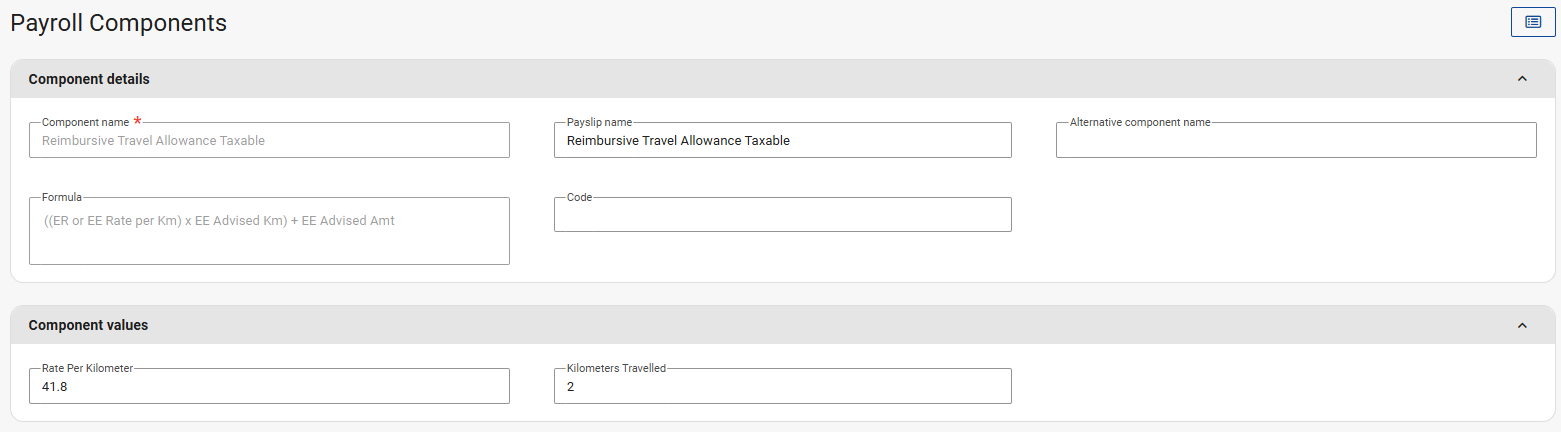

If you reimburse more than the prescribed SARS rate per kilometre, the employee will be taxed on the difference/excess. If no rate is entered, you will get a payroll error “Reimbursive travel allowance requires a rate per km”. To split the taxable and non-taxable portions correctly, you must enter a rate/km.

Related Articles

How do I update the rate on the Reimbursive Travel Allowance component?

This feature is available on all Deel Local Payroll powered by payspace payroll editions A Reimbursive Travel Allowance is an allowance which is based on the actual distance travelled for business purposes (excluding private travel). These amounts ...How do I configure the Reimbursive Travel Allowance (taxable and non taxable) claim components to automatically apply the SARS rate per hour?

This applies to all Deel Local Payroll powered by payspace payroll editions A Reimbursive Travel Allowance is an allowance which is based on the actual distance travelled for business purposes (excluding private travel). These amounts are normally ...How do I resolve the payslip error: "Reimbursive Travel allowance requires a rate per km", when adding the Reimbursive Travel Allowance Non Taxable/Taxable component?

This feature is available on all Deel Local Payroll powered by payspace payroll editions When adding the taxable or non-taxable Reimbursive Travel Allowance component to an employee's payslip, the "Reimbursive Travel allowance requires a rate per km" ...How do I correct an employee's Reimbursive Travel Allowance that has been incorrectly captured against tax code 3702 (taxable) instead of tax code 3703 (non taxable)?

This applies to all PaySpace editions. For example, an employee travelled 120km in May 2024, but it was incorrectly captured on tax code 3702 (Reimbursive Travel Allowance Taxable) instead of 3703 (Reimbursive Travel Allowance Non-Taxable). However, ...How do I configure the Travel Allowance component, taxed at 20%?

This feature is available on all Deel Local Payroll powered by payspace payroll editions When the Travel Allowance component is linked to an employee's Edit Payslip or Recurring Payroll Components screen, 80% of the amount will be taxable by default. ...