How do I configure a Foreign or Local Subsistence Allowance component?

This feature is available on all Deel Local Payroll powered by payspace payroll editions

In South Africa, a subsistence allowance is an amount paid to employees to cover the costs associated with meals, accommodation, and incidental expenses while they are away from their usual place of residence for work-related purposes. This allowance helps employees meet the additional costs they may incur during business travel, whether within the country (local subsistence allowance) or abroad (foreign subsistence allowance).

Local Subsistence Allowance: The local subsistence allowance applies to business travel within South Africa. It covers expenses such as meals, accommodation, transport, and incidental costs incurred by employees while traveling for work-related purposes within the country.

Foreign Subsistence Allowance: The foreign subsistence allowance is applicable for business travel outside of South Africa. It serves the same purpose as the local subsistence allowance but applies to international trips, covering costs associated with meals, accommodation, transport, and incidental expenses incurred during work-related travel abroad.

It's important to note that these allowances are subject to specific tax regulations and guidelines set by the South African Revenue Service (SARS). Employers must comply with these regulations when providing subsistence allowances to their employees and ensure proper reporting and taxation of these allowances. Employees should also be aware of the tax implications related to these allowances.

Step 1: Determine whether the Subsistence Allowance is Local or Foreign and if it will be taxed or not, then create the applicable component on company level.

Navigate > Configuration > Payroll > Payroll Config > Payroll Components

Navigate > Configuration > Payroll > Payroll Config > Payroll Components

Taxable codes 3704 and 3715 are applicable where the allowance paid for expenses in respect of meals and/or

incidental costs for local and foreign travel respectively, exceed the deemed

amounts.

Non-taxable codes 3714 are applicable where the allowance paid for expenses in respect of meals and/or incidental costs for local and foreign travel respectively, do not exceed the deemed amounts.

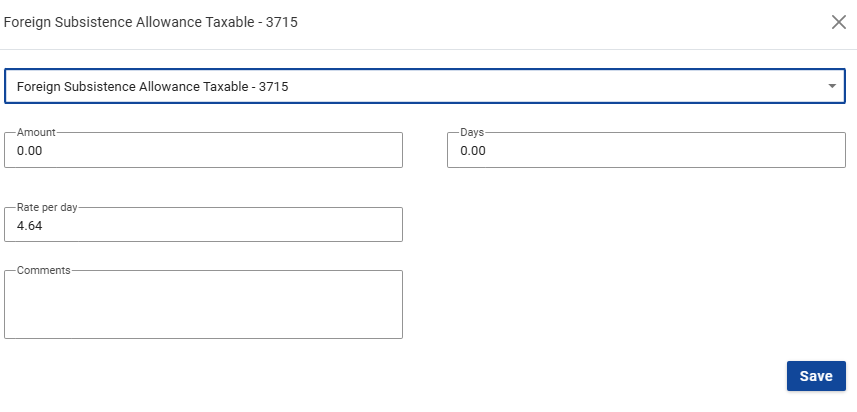

Step 2: Depending on the component created, add it onto the employee individually on their Edit Payslip or Recurring Payroll Components screens or collectively on the Bulk Actions screen.

The Edit Payslip screen

Navigate > Payroll Processing > Edit Payslip > Allowances

The Bulk Actions screen

The Bulk Actions screen

Related Articles

How do I configure a Foreign or Local Subsistence Allowance as a claim component?

This feature is available on the Premier or Master edition Make use of the following steps to configure the component to be submitted on the Claims screen. Step 1: Ensure that the Foreign or Local Subsistence Allowance component is added and the Rate ...How do I set up a Recurring Bursary component that is non-taxable?

This feature is available on all Deel Local Payroll powered by payspace payroll editions The Non-Taxable Recurring Bursary component has to be configured on company level before it can be linked to employees. Step 1: Confirm the NQF Level of the ...Payroll Processing | Recurring Payroll Components

A Recurring component refers to a regularly appearing component in an employee's payroll that is a part of the employee's regular compensation package. These components are calculated and included in each pay period, and are an essential part of an ...How do I remove a recurring component?

This feature is available on all Deel Local Payroll powered by payspace payroll editions Once Recurring components are linked on employee level, they cannot be deleted on company level. However, they can be made inactive. Payroll Components Step 1: ...How do I resolve the payslip error: "Reimbursive Travel allowance requires a rate per km", when adding the Reimbursive Travel Allowance Non Taxable/Taxable component?

This feature is available on all Deel Local Payroll powered by payspace payroll editions When adding the taxable or non-taxable Reimbursive Travel Allowance component to an employee's payslip, the "Reimbursive Travel allowance requires a rate per km" ...