How do I activate the Retroactive function?

This feature is available on the Master payroll edition.

The Retroactive Functionality allows you to process backdated payroll changes. When activating a retroactive calculation on the Bulk Actions Screen, the system will automatically calculate the difference between the old and the new value of all relevant components. These differences will display on a Retroactive Payslip Record, by means of an Interim Run.

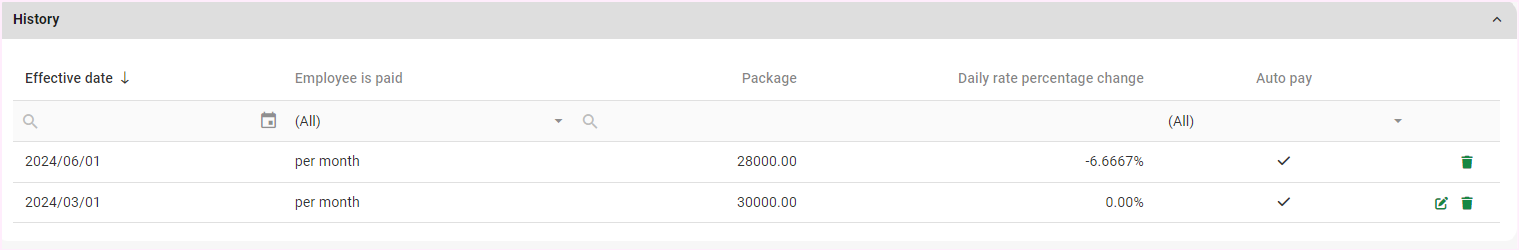

Before the Retroactive function can be activated, process a back-dated pay rate record with a past effective date on the Pay Rate Details screen.

Navigate > Employee > Payroll Processing > Pay Rate Details > History

The system will not automatically prorate the salary if the Effective Date of a pay rate record is mid-month.

To activate a retroactive calculation, update the Retro Trigger template on the Bulk Actions screen.

Download an empty MS Excel Template for the Action Type, Retro Trigger.

Navigate > Bulk Actions

Process the details of the employees who qualify for retroactive pay.

Once the spreadsheet is successfully uploaded, an interim run will be automatically created on the Payslip Pay Date screen.

Navigate > Payroll Cycle > Payslip Pay Dates

Retroactive Payslip Records will be generated to pay the backdated pay. The payslip will calculate all components that are influenced by the pay rate, and will also show the calculated amount per month in the comments.

Navigate > Employee > Payroll Processing > Edit Payslip

In light of the above example, the retroactive calculation will start with the March payslip record and apply the backdated pay rate in the Retroactive Environment. By default, all Non-Legislative Components will calculate as if it happened in March.

Once completed, the system will apply a comparison of the payslip record in the Retroactive Environment to the payslip record of March. The difference will display on the Retroactive Payslip Record. Comments will automatically generate to specify the difference calculated for each relevant month. The same process will be applied in each run between the effective date of the backdated pay rate and the current open run.

Another example would be as follows: The current Open Run is August 2024. A backdated pay rate record is processed with an Effective Date, 1 January 2024 on the Pay Rate Details Screen. The retroactive calculation will only be applied from March to June, ignoring January and February.

Payments for work done in a previous tax year should be processed in an Interim Run that is associated with February.

Related Articles

What does the Retroactive function allow me to do?

This feature is available on the Master payroll edition. The Retroactive Function allows you to process backdated payroll changes, due to union negotiations, late approval of increases/promotions or any other reason. When activating a retroactive ...On which payroll edition of PaySpace should I be on to use the Retroactive function?

This feature is available on the Master edition. The Retrospective Function allows you to process backdated payroll changes, and is only available on the Master payroll edition for companies registered for the tax authority: South Africa. Related FAQ ...How do I activate the Pacey module?

This feature is available on all Deel Local Payroll powered by payspace payroll editions Pacey is an optional/additional module available for purchase as an add-on to the system. Contact the Sales Department at sales@payspace.com for further ...How do I activate the Power BI module?

This feature is available on Premier and Master editions The Power BI module is an add-on module which is billed separately per user. Contact the Sales department sales@payspace.com for further assistance.Components | The Sub-Code Function: A Flexible Income Base

About When an income base has been configured to allow for sub-code functionality the Compliance team ensures that the correct tax codes are by default included in the income base. This is normally used on note components to support statutory ...