Can I reverse an incorrectly captured tax directive once the run has closed?

Yes. The system has been enhanced to allow an incorrectly captured tax directive to be reversed after the run in which it was captured has been closed.

If the directive was captured on a terminated employee's record, create an interim run linked to the run in which their last payslip was created to process the reversal.

If the directive was captured in the previous tax year, a February or August interim run will have to be created to process the reversal.

Related FAQ

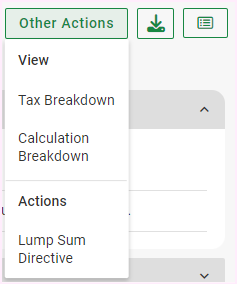

Navigate > Employee > Payroll Processing > Edit Payslip > Other Actions > Lump Sum Directives

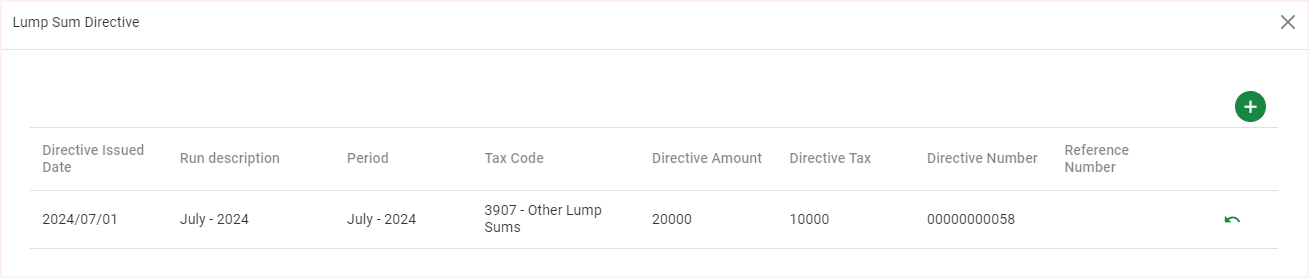

After creating the interim run and payslip that is linked to the interim run, the Lump Sum Directive screen may be accessed to reverse the lump sum.

Click on the "reverse" icon against the relevant tax directive on the Lump Sum Directives window.

Click on the "reverse" icon against the relevant tax directive on the Lump Sum Directives window.

Related Articles

Where do I add an employee's Lump Sum (tax) Directive?

This feature is available on all Deel Local Payroll powered by payspace payroll editions The purpose of a tax directive is to enable SARS to instruct an employer on how to deduct employees' tax from certain lump sums to a taxpayer or member. An ...How to add or edit an employee's tax directive's (lump sum) issue date?

This feature is available on all PaySpace editions. Make use of these steps to add or edit the tax directive issue date: Navigate > Employee > Payroll Processing > Edit Payslip > Other Actions > Lump Sum Directive Navigate > Bulk Actions Step 1: ...Which report can I extract to view employee lump sum and tax directive payments?

This report is available on all PaySpace editions. To view employee lump sum and tax directive payments, generate the "Lump Sum Report". Navigate > Reports > Reports > Classic > PayrollHow do I create an interim run linked to a closed run?

This feature is available on all Deel Local Payroll powered by payspace payroll editions An interim run can be linked to a closed run on the Run Management screen. Navigate > Payroll Cycle > Run Management > Closed Runs Step 1: Click on the + icon on ...Where can an employee’s tax directive number be viewed?

The purpose of a tax directive is to enable SARS to instruct an Employer, how to deduct employees' tax from certain lump sums to a taxpayer or member. An employee's directive number can be viewed on the "Other Actions" button in the top right hand ...