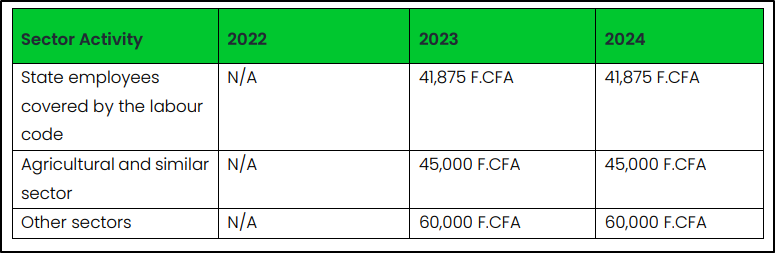

Cameroon | CNPS Sector Activity Minimum

There are various minimum amounts for CNPS Revenue, which depend on the activity of each sector. The CNPS Revenue base cannot be lower than the Guaranteed Minimum Interprofessional Wage (SMIG), which is set at 36,270.00 per month.

Minimum:

The minimum CNPS amount for each sector activity are as follows:

For a sector activity minimum to be applied, a selection must be made on the statutory custom field ‘Sector Activity’ on the Basic

Company Information screen.

If no Sector Activity is

chosen, then the old minimum wage of 36 270 CFA

francs will apply. If the employee has income less than

the applicable minimum wage, then the minimum

wage will return as the income. If the employee is new or terminated within the month,

then the minimum wage will be pro-rated based on the

“Number of Days Worked” note component. The

minimum will be divided into 30 and multiplied by the

number of days worked.

Maximum:

The maximum monthly base applied is 750 000.00 CFA

francs. The max is not pro-rated if the employee is new

or terminated within the month.

Related Articles

Cameroon | How To Exclude Fringe Benefits From CNPS Revenue (NSIF)

Fringe benefits can be included/excluded from the calculation of CNPS Revenue(NSIF). To include/exclude Fringe benefits navigate: Config> Basic Settings> Company Settings> Basic Company Information On the drop down option select the appropriate ...Cameroon Product User Guide

To aid our users in the understanding and application of compliance in Cameroon, PaySpace has released an external Product User Guide. This is a "How to guide" to follow during country implementations, company maintenance and for support queries.Cameroon Payroll Tax Guide 2024

The Cameroon Payroll Tax Guide is an easy-to-understand summary of statutory contributions associated with payroll for the 2024 tax year.Tunisia | Work Accident and Occupational Disease Sector Percentage

The Work Accident and Occupational Disease component calculates based on a sector percentage. The percentage varies according to the sector of activity, ranging from 0.4% to 4%. The percentage must be advised on the component. Navigate: Config> ...Cameroon | How to Exempt an employee from CRTV Contributions

The Audiovisual Communication Tax (RAV) is a license fee intended to contribute to the development of audiovisual activity instituted for the benefit of the Cameroon Radio-Television Corporation (CRTV). Exemptions of CRTV contributions do apply to ...